The New Year has passed and New Year’s Resolutions seem a distant memory. However, one resolution needs to be revisited – wiping out or managing your debt. If you are stressed out by the inability to keep up with your credit card bills, your house payments, your personal loans, and the like, there is something you can do about it. If creditors are hounding you and you can’t sleep at night and you need meds, there is something you can do about it. If your credit card minimums are through the roof, or you just can’t make any payments, there is something you can do.

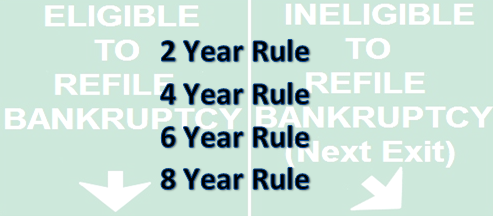

Bankruptcy may be a solution to your problems or maybe not. It is time to explore this alternative. Some people think that filing for a Chapter 7 bankruptcy will result in the denial of future credit for ten years. In fact, this is not so. It may appear on your credit report for ten years but the anecdotal history of my clients reporting their experience to me over the thirty (30) of practicing consumer bankruptcy suggests that it may only take two years to sufficiently repair your credit for you to get a house, co-op or condo. It is not an automatic that you get your credit back; it takes a deliberate strategy of getting a secured credit card at first and always using the card and paying off the balance each month so that your new record of timely payments will lead to offers for unsecured credit cards. An incremental, step-by-step approach to fixing your credit will enable you to get back in the credit scene in short order.

If you want to explore this option, call the Bronx/Westchester Bankruptcy Attorney for a free telephone consultation. A fresh start may begin here and now. 718 881-7964.