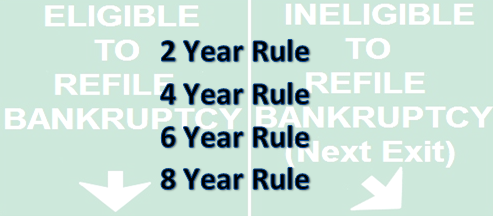

There are many reasons why you might need to filing a Chapter 7 or Chapter 13 bankruptcy a second time; but, you need to know the rules of the road with the help of a knowledgeable and solid bankruptcy attorney.

2 Year Rule

This applies when you have successfully completed a Chapter 13 (you received your discharge) and need to file again. This may occur because you may owe post-filing taxes or mortgage arrears. You may file again and receive a discharge if two year elapsed from the date of the first filing. Thus, if you filed a Chapter 13 on March 1, 2011 and receive a discharge on March 1, 2016, you may immediately file another Chapter 13 and get a discharge. The two year period is measured from date of the first filing to the date of the second filing. Thus, almost everyone will be eligible in this scenario to file and get a discharge because almost all successful Chapter 13 bankruptcies take longer than 2 years to complete.

4 Year Rule

This applies when you have successfully completed a Chapter 7 (received a discharge) and wish to file a Chapter 13. This may occur because you owe taxes that were non-dischargeable in the Chapter 13 or you may wish to wipe out a totally underwater 2nd mortgage that could not be done in a Chapter 7. This does not mean that could not file a Chapter until 4 years after a Chapter 7. You could but you will not receive a formal discharge notice. In many cases, it will not be necessary to have the discharge. Once again, the 4 year period is measured from date of the first filing to the date of the second filing.

6 Year Rule

This applies when you have successfully completed a Chapter 13 and now wish to file a Chapter 7. In order to receive a discharge in the subsequent filing, there is a look back to the previous Chapter 13. If 6 years have gone by from date of filing on the Chapter 13 to the date of filing on the Chapter 7, you will be eligible to receive a discharge in the Chapter 7. However, you still may get a discharge in less than 6 years if you paid back 100% of your debts in the prior Chapter 13 or you if paid back 70% of your debts and the plan was both proposed in good faith and was your best efforts. This is a little more complicated that the other rules and will need an experienced Bronx/Westchester attorney to assist you.

8 Year Rule

This applies when you have successfully completed a Chapter 7 and now wish to file another Chapter 7. Once again, the measuring period is from the date of filing of the first bankruptcy to the date of filing for the second Chapter 7.

These rules can be highly nuanced and the choice of refiling can be very tricky. You should only consult a competent and experienced Bronx/Westchester consumer bankruptcy attorney before making such a decision. There are so many traps for the unwary.